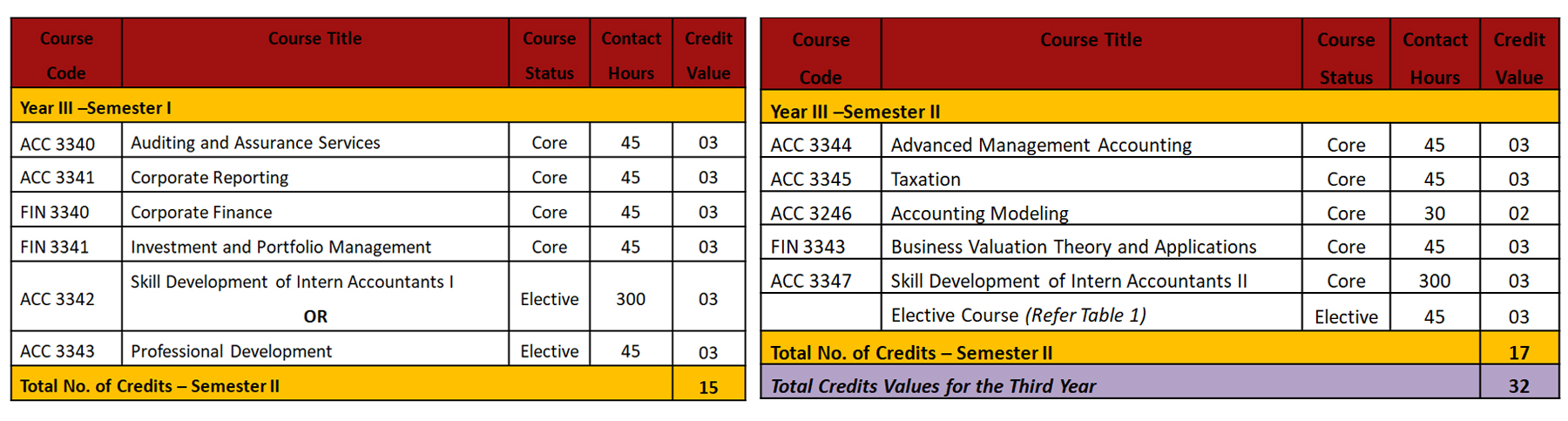

Third Year- Accounting Specialization

Curriculum of the Third Year

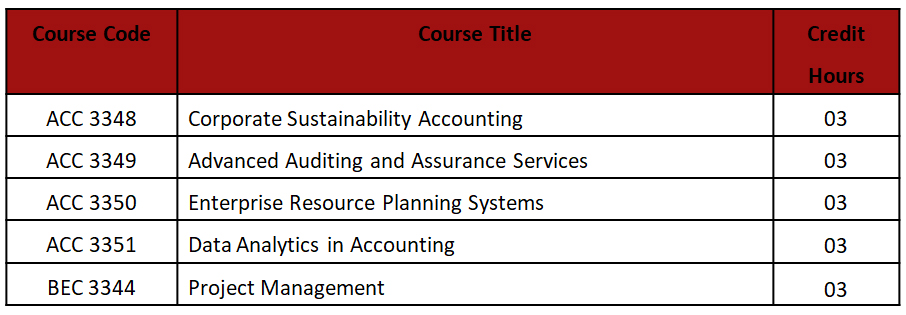

Table 1: Elective Courses – Year III, Semester II

ACC 3340: AUDITING AND ASSURANCE SERVICES

This course provides students with a comprehensive understanding of auditing principles, concepts, techniques, and procedures to develop their understanding of the audit function and examine the techniques used by the auditors including risk analysis, evidence collection and evaluation, and audit reporting. Further, it familiarizes students with the professional, ethical, legal, commercial and regulatory requirements within which audits are carried out. The areas covered include audit planning, quality control for audit work, internal control, audit evidence, using the work of others, auditor’s involvement in special purpose audit engagements and other assurance services. In addition to this, the program introduces the use of computer assisted audit techniques and considers issues related to computer information systems audit.

FIN 3340: CORPORATE FINANCE

Th¬is is an advanced course in Financial Management. ¬e major areas covered include; however not limited to: risk and return, advanced techniques and risk involvement in capital budgeting, cost of capital, capital structure, dividend policy, hybrid financing, leasing, working capital management, corporate financial strategy, financial distress and restructuring. ¬This course provides necessary knowledge in evaluating different corporate finance decisions and their influence on corporate performance and value. Students get the opportunity to analyse cases using concepts and techniques of corporate finance to address problems faced by finance managers.

FIN 3341: INVESTMENT AND PORTFOLIO MANAGEMENT

This course is designed to provide students with basic concepts, theories and practices in understanding, analyzing and making decisions in investment and portfolio management. ¬e course discusses investor behaviour, capital markets, risk and return, portfolio analysis, capital asset pricing model, factor models, arbitrage pricing theory, valuation and analysis of fixed income and variable income securities, financial derivatives and their use for hedging portfolio risk, portfolio performance evaluation and international investment. It also discusses empirical findings on these topics to understand the application of them in practice.

ACC 3341: CORPORATE REPORTING

This course familiarizes the students with corporate reporting practices and issues involved in the publication of financial and non-financial information of companies, including groups of companies and public sector corporations, and enable them to appraise and critically evaluate current practices adopted in corporate reporting. The following study areas are covered: corporate reporting environment; role of corporate governance and ethical considerations in corporate reporting; social responsibility reporting, sustainability reporting, integrated reporting; accounting for financial instruments, share based payments, biological assets; and reporting on operating segments and financial performance based on applicable LKAS and SLFRS; and financial reporting in public sector organisations.

ACC 3342: SKILL DEVELOPMENT OF INTERN ACCOUNTANTS I

This course, the first of the four units conducted under the Skill Development Program of Intern Accountants, emphasizes on the development of Accounting and Financial Management Skills, and Management and Personal Capacity Skills. These skills are developed through the Internship Program in Accounting and Finance and workshops and projects conducted on management and personal capacity skills development.

ACC 3343: PROFESSIONAL DEVELOPMENT

This course unit is designed with the intention of upgrading the soft skills and developing the personalities of students. It focuses on the development of communication, leadership, management capability and networking skills of students and instilling business ethics in them. An interactive approach is adopted in the delivery of the program.

ACC 3344 : ADVANCED MANAGEMENT ACCOUNTING

This is an advanced level course, which deals with selected techniques and practices associated with Management Accounting. The emphasis is on modern applications and recent developments in the spheres of management accounting. The areas covered are: evolution of management accounting; further aspects of capital investment decisions and pricing decisions; budgetary control and beyond budgeting; activity based management and distribution channel analysis; balanced scorecard; responsibility accounting; decentralization and related issues; transfer pricing; project management; management accounting research; service sector costing; and introduction to strategic management accounting.

ACC 3345: TAXATION

This course provides students with a sound understanding of principles of taxation and enables them to apply theoretical knowledge in practice. The areas covered are: introduction to principles of taxation; liability to income tax; sources of income (employment income, income from property, dividend income, interest income, income from any other sources, trade business profession and vocation, income from any other source); capital allowances, total statutory income (TSI), assessable income (AI), taxable income, calculation of income tax of individuals, companies, charitable institutions, clubs, trade associations and co-operative societies, tax concessions, tax credits, calculation of income tax payable; payment of income tax under self-assessment system; appealing procedure, recovery of tax, tax refund, and value added tax (VAT).

ACC 3246: ACCOUNTING MODELLING

This course familiarizes the students with IT based accounting information systems and their role in organizations, particularly in their use in strategic and operational decision-making as a supporting tool for managers. e following study areas are covered: spread sheet principals and auditing tools; revision of spread sheet decision logic; important tools in spread sheet models; use of pivot table; case studies on accounting related spread sheet decision logics; modelling the accounting equation; financial functions; look up functions; sensitivity analysis; solver; macros and product cost and CVP modelling.

FIN 3343: BUSINESS VALUATION THEORY AND APPLICATIONS

Th¬is is an advanced course in the theory and practice of valuation of business and equities. ¬e major areas to be covered include free cash flow valuation, dividend discount based valuation, economic profit valuation, adjusted present value method, relative valuation and contingent claim valuation. It focuses on reorganizing financial statements, analysing business performance and competitive position together with their forecasts in order to use for different purposes such as investments, acquisitions and takeovers.

ACC 3347: SKILL DEVELOPMENT OF INTERN ACCOUNTANTS II

This course, the second of the four units conducted under the Skill Development Program of Intern Accountants, emphasises on the development of Accounting and Financial Management Skills, and Communication Skills. These skills are developed through the Internship Program in Accounting and Finance, and the communication skills development sessions conducted by the Skill Development Centre (SDC), the language laboratory of DA.

ACC 3348: CORPORATE SUSTAINABILITY ACCOUNTING

This course enables the students to practically appreciate the concept of sustainability and its importance of accounting in striving towards corporate sustainable development. The areas covered are: new developments in accounting towards sustainability; environmental management accounting (scope, techniques, applications, drivers and roadblocks), accounting for the social dimension, integration of the three pillars of sustainability, sustainability reporting and theoretical aspects of sustainability. The course unit, while providing students with sound understanding in concepts and techniques related to the three pillars of sustainability, i.e. planet, people and profit, critically evaluates the role of accounting in a pragmatic approach.

ACC 3349: ADVANCED AUDITING & ASSURANCE

This course provides students with a sound conceptual understating of key topics in governance, risk and modern risk based auditing, and equips students with the skill of applying International Standards on Auditing (ISAs) in auditing a set of IFRS compliant financial statements. The areas covered are: governance, risk and controls; accountability and audit; ethical issues; current and emerging trends that has reshaped auditing professions; audit quality and practice management; integrated internal control framework; risk based audit planning; formulating testing strategies; audit of complex areas; audit reporting; and sustainability audits and assurance. In the delivery of the course, the case study analysis is also adopted.

ACC 3351: DATA ANALYTICS IN ACCOUNTING

This course aims to equip the students with necessary skills and knowledge in using data analytics to identify, capture, evaluate and resolve accounting and business-related issues and problems using appropriate data modeling and analytical tools. The students will be exposed on how data is collected, created, warehoused, and shared and will be able to recognize and evaluate the reliability of sources of structured and unstructured data for use in analysis. Then, the students will get an understanding on using data mining techniques to discover fraud and anomalies in accounting and financial data using simulation and stochastic modeling techniques with non-discrete inputs and outputs. Moreover, the students will gain insights on predictive analytics, optimization, correlation of metrics, and big data. In addition, the students will be able to use visualizations techniques of data in gaining insights into associations, outliers and other data anomalies. The course also will expose the students on business risks and ethical issues related to data gathering, storing, and usage.

ACC 3352: ENTERPRISE RESOURCE PLANNING SYSTEMS

This course introduces the students to interdependent software modules with a common central database that support basic internal business processes for finance and accounting, human resources, manufacturing and production, and sales and marketing. Enabled data to be used by multiple functions and business processes for precise organizational coordination and control. e course is expected to cover Accounting, Stock Control, Assets Register, Payroll, HRM, Time Attendance and Point of Sales. is course emphasizes on Accounting module for students with a linkage for another modules.

BEC 3344: PROJECT MANAGEMENT

This course provides the students with advanced knowledge and skills on Project Management in business organizations or entirely project based organizations. This course covers the theoretical foundation of Project Management techniques, software training and practical elements of real-world projects undertaken by the students. At depth, this is the study of nine Project Management knowledge areas: project integration management, scope management, schedule management, cost management, quality management, human resource management, risk management, communication management and procurement management. In addition, the students undergo a thorough training of MS Project software (usually the latest accessible version) to be competent in meeting the challenges in the real business setup under project management.